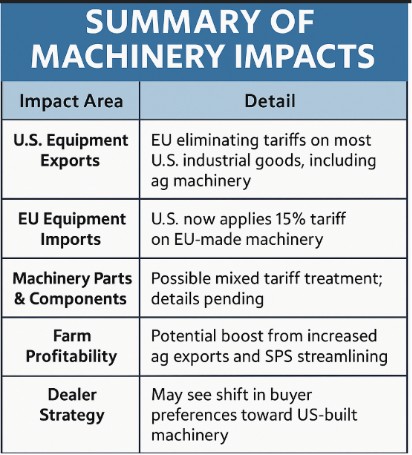

In late July 2025, the United States and European Union announced a new trade agreement that restructures tariffs and market access across multiple sectors, including agriculture and industrial goods. While the headlines focused on energy, steel, and aerospace, this deal carries important implications for U.S. agricultural machinery manufacturers, farmers, and equipment importers.

Here’s a breakdown of what’s actually in the deal and how it could affect the ag machinery market.

U.S. Machinery Exports to Europe: Tariffs Eliminated

Under the new agreement:

- The European Union will remove tariffs on most U.S. industrial goods, including agricultural equipment.

- This change is intended to improve market access for U.S. manufacturers, who previously faced tariff barriers when exporting machinery to Europe.

This could make American-made tractors, planters, combines, and other equipment more competitive in the EU, particularly as European buyers seek lower-cost alternatives amid global inflation and supply chain disruptions.

EU Machinery Imports to U.S.: 15% Tariff Applied

On the import side:

- The United States will apply a 15% tariff on most European industrial goods entering the U.S. This includes agricultural machinery manufactured in the EU.

- Prior to this deal, many of these goods entered at much lower effective tariff rates, often under 3%.

Affected brands may include European-based manufacturers such as Fendt (AGCO), Claas, Krone, and Kuhn. This tariff increase is expected to raise the cost of new EU-manufactured machinery sold in the U.S. and could shift demand toward North American-built alternatives.

Parts & Components: Mixed Outcomes

While final product tariffs are clearly addressed, the status of components and spare parts is more complex:

- Some categories of machinery parts may fall under “zero-for-zero” provisions where both sides agreed to eliminate tariffs on specific products.

- As of July 29, 2025, full category lists have not been publicly released, so the impact on parts and service operations remains uncertain.

If key precision farming components or specialty EU parts are not exempted, this could increase costs for U.S. repair shops and farmers maintaining European-built equipment.

Agriculture Exports & Farm Income

The broader deal also includes provisions that benefit U.S. agriculture overall:

- The EU agreed to eliminate tariffs on various U.S. agricultural exports, including certain grains and processed ag goods.

- The deal also involves streamlining sanitary and phytosanitary (SPS) regulations, which have historically limited U.S. exports of meat, dairy, and genetically modified crops.

While not directly tied to machinery, increased farm income from export growth could spur greater investment in equipment upgrades by U.S. producers.

Final Notes

As with any major trade agreement, implementation details matter. Final product and component lists, enforcement mechanisms, and regulatory harmonization efforts are still being developed. For now, the most immediate, confirmed impacts are:

- Tariff-free access for U.S. ag equipment entering the EU

- New 15% tariff on European machinery entering the U.S.

These provisions are likely to reshape equipment pricing, demand flows, and long-term supply chain strategies across the ag sector.

For continued updates on how this impacts equipment markets and auction values, follow Tractor Tuesday’s blog and price reports. To keep on eye on equipment trends, follow our blog. Cheers, JD Bonham

Leave a Reply