For generations, John Deere has been known for building some of the most reliable machines in agriculture. But in recent years, the company has been transforming its business model. It is no longer just a manufacturer of tractors and combines. Deere is becoming a technology company focused on the intelligence layer, which includes the software, data, and connected services that surround its machines.

This shift changes how Deere generates revenue. Instead of relying solely on one-time equipment sales, the company is building recurring income streams through subscriptions, connectivity, and precision agriculture tools that stay active long after the machine leaves the lot.

From Product to Platform

Historically, Deere made money when a farmer purchased a piece of equipment. That model is now evolving into a hybrid of hardware and software. The company’s “Solutions as a Service” approach includes usage-based pricing, subscription tiers for precision-ag tools, and connected maintenance services.

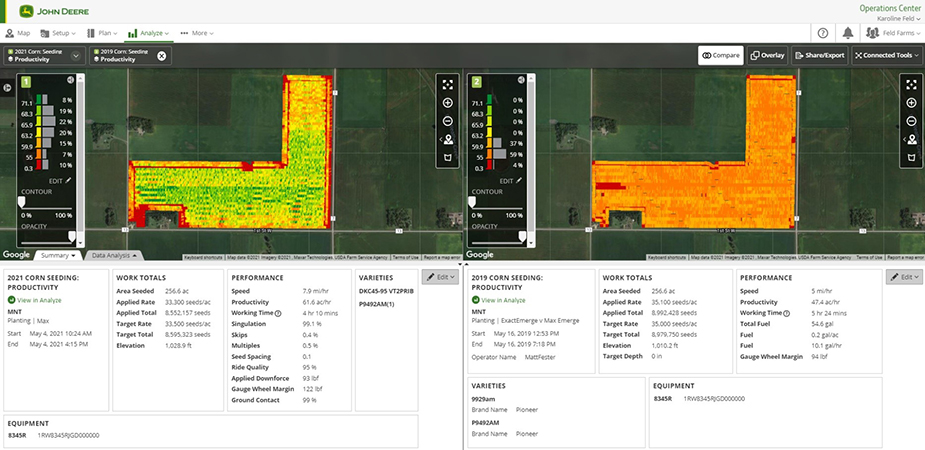

The John Deere Operations Center is at the heart of this transformation. It connects machines, field data, and sensors into one ecosystem. Farmers can monitor fleets, manage agronomic data, and analyze performance from anywhere. Once that system becomes integral to farm operations, switching away from it is difficult, and that steady connection turns into reliable revenue for Deere.

For the company, this model smooths out earnings that used to fluctuate with machinery demand. For farmers, it promises improved efficiency and lower input costs.

New Technology Driving the Change

Deere’s push into intelligence is built around a few cornerstone technologies. Autonomous tractors and sprayers now use computer vision and machine learning to recognize crops and weeds. The See & Spray Ultimate system, for instance, uses cameras and onboard AI to spray only where weeds are detected, reducing chemical use by more than half in many cases.

Telematics also plays a central role. With JDLink and Connected Support, dealers can remotely monitor a machine’s diagnostics and alert operators before failures occur. Predictive maintenance, route optimization, and fuel efficiency data all flow into the Operations Center, giving farmers insights that were never possible before.

Even the way features are activated is changing. Many are now software-licensed or subscription-based rather than permanent hardware upgrades. This flexibility allows farmers to pay per acre or per season for specific features instead of making large upfront investments.

Why Farmers Will Pay

Subscription models can feel frustrating, especially when applied to everyday technology. But in farming, the equation is different. If a subscription saves money or improves efficiency, it becomes an investment rather than a burden.

For example, precision spraying and autonomous systems can significantly cut input costs. Remote diagnostics can prevent downtime during planting or harvest. Data-driven decision tools can fine-tune seeding and fertilizer rates to boost yields. When the savings from these tools outweigh the cost of the subscription, most farmers will see value in paying for the service.

Deere’s approach also lowers barriers for smaller or mid-sized operations. Paying for precision tools on a per-acre basis can make high-end technology more accessible without requiring new equipment purchases.

The Future of Smart Farming

While the benefits are clear, concerns remain. Some farmers worry about being locked into a single ecosystem. Others question who truly owns the data collected from their fields. Connectivity and training are also hurdles, particularly in areas with limited broadband access or limited tech experience.

The success of Deere’s model depends on whether the services deliver measurable results. If they consistently reduce inputs, improve yields, and prevent breakdowns, many farmers will view subscriptions as a smart addition to their operations. But if the value feels abstract, adoption will slow. In the end, the promise of precision and efficiency could make these services less of an expense and more of a competitive edge for those who adopt them.

John Deere’s move toward a software and service-driven model represents a major shift in modern agriculture. It reflects a future where intelligence per acre matters as much as horsepower per acre. Machines are becoming data platforms, and farmers are becoming both operators and analysts. It’s an exciting shift to watch unfold in the world of agricultural innovation.

Leave a Reply